HSBC's Personal Finance Management and Insurance teams approached us with a high level brief to merge a few of the features on their HK HSBC mobile app. As well as a mandate to explore alternative UX and UI elements that would engage with the GenZ and Millennials market segment.

- Client

- HSBC

- What we did

- Strategy, UX&UI Design

The Challenge

HSBC's Personal Finance Management and Insurance teams approached us with a high level brief to merge a few of the features on their HK HSBC mobile app. As well as a mandate to explore alternative UX and UI elements that would engage with the GenZ and Millennials market segment.

The project brief was extremely broad, so we were tasked to tackle a few design challenges during the pitch stage, we clearly hit the mark as we were awarded the project. And that is where the true work began. Our first task was to align the different business units' goals and objectives for the project and create a united vision for the project.

The Work

First order of business was to plan and host a half day discovery workshop, where we had 10 key stakeholders from the client side attending. In the session, we were able to begin aligning the overall objectives and goals for the project, some high level KPIs and established a definitive set of deliverables. We turned the findings into a 'strategic vision deck' and presented it to the client to ensure that we were aligned. The entire process was highly collaborative.

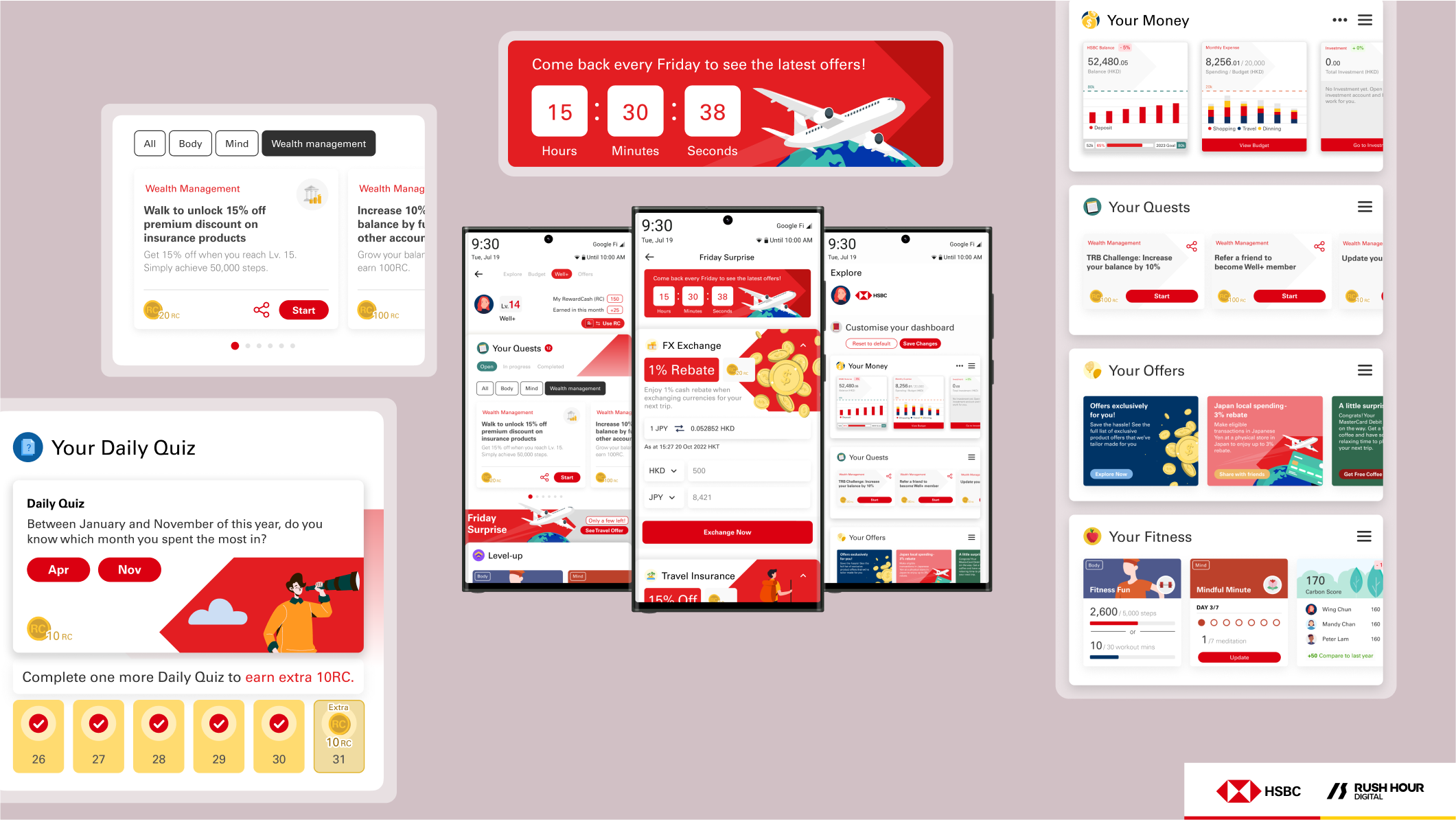

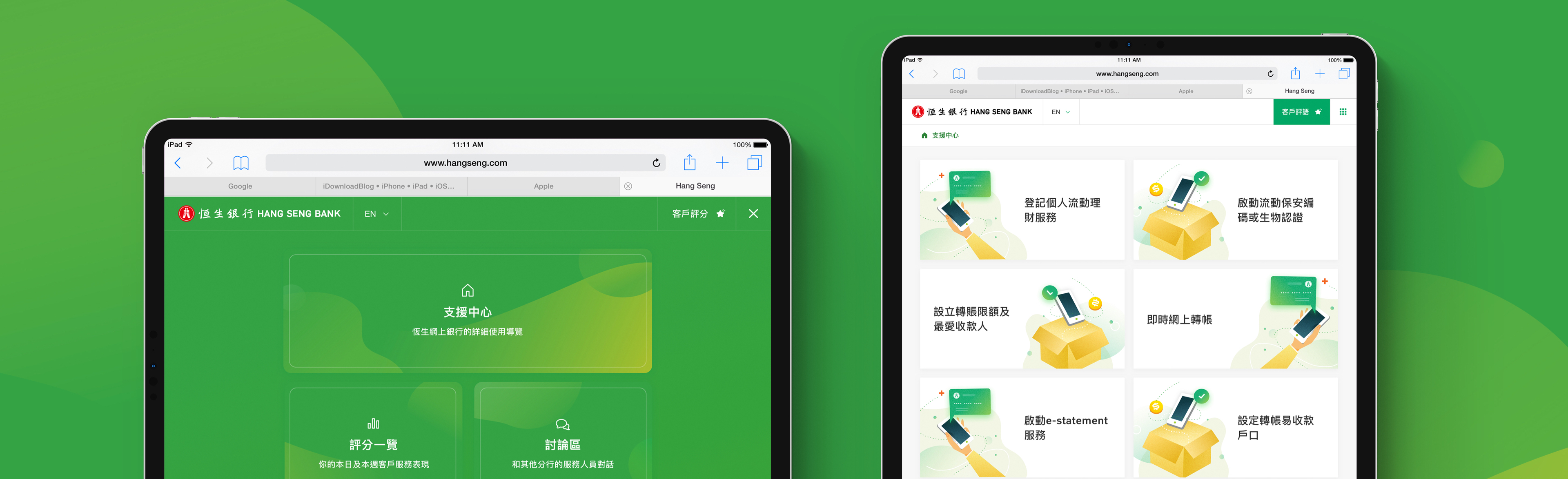

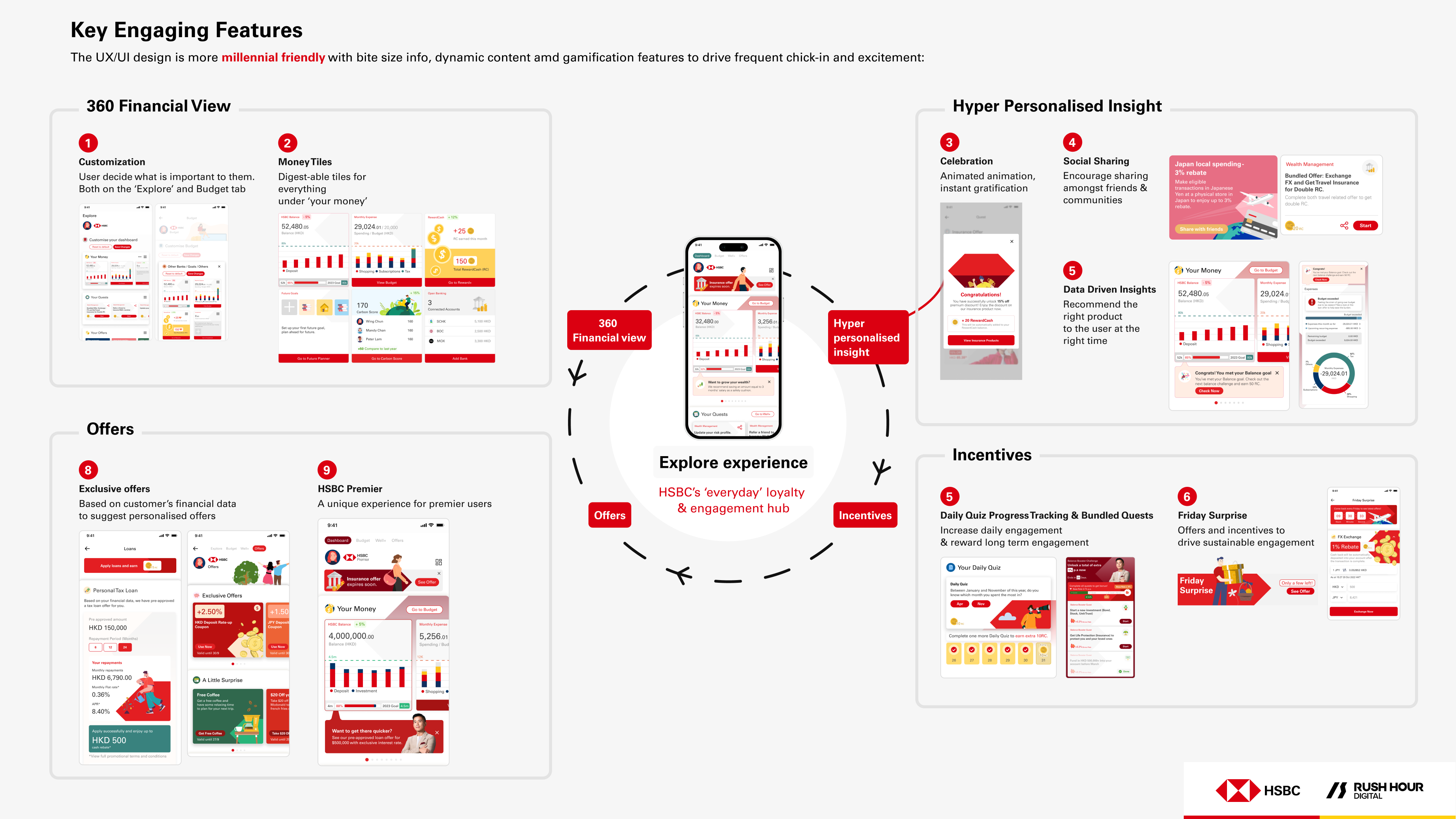

The HSBC team had a large library of data gathered from various user research activities that they engage with. We gathered and analysed all of the information that was relevant to this project. As well as conducted our own table top research, with a focus on digital banks like Mox, Za Bank, Livi Bank, etc, as they were the active within the market segments that we were aiming for. From there we created 5 main use case prototypes and introduced new features, user journeys, UI, components, customisation tools, 2 distinct aesthetics for different market segments, seasonal engagement mechanics, gamification elements and loyalty program. Throughout the project, we prepared multiple decks to document the journey, work and detailing the rationale for all of our recommendations and research findings.

The Result

We were very fortunate to have be given the opportunity to present our work to the ExCO of HSBC, which is made up of the regional and local C suit executives, which gave our work great exposure within the organisation. Our work was also surveyed with hundreds of HSBC customers that are on their user testing program. The overall feedback was extremely positive. Especially around the gamification, fixed deposit and loyalty program features.